'Mild expansionary path' likely in 2026 fiscal plan

From a global perspective, we anticipate that China-US relations will remain in a state of balance in 2026. Over the long term, the Trump administration's acceleration of the "destructive restructuring" of US hegemony could speed up the internationalization of the renminbi and the overseas expansion of Chinese enterprises.

Domestically, the fourth plenary session of the 20th Central Committee of the Communist Party of China has unveiled a top-level design for the country's economic and social development over the next five years. During the 15th Five-Year Plan period (2026-30), China's economic growth rate may reach around 4.8 percent, thereby strengthening the foundation while boosting emerging industries.

We believe that policies aimed at building a modernized industrial system could achieve the effect of "setting everything right with one move", with significant progress expected in technological innovation, industrial upgrading, and the comprehensive rectification of involution-style competition.

Furthermore, policy focus will tilt toward demand to stimulate domestic consumption, with services consumption coming to the fore. Looking ahead to 2026, we expect the macroeconomy to show a mild recovery trend under structural divergence, with economic growth potentially being lower in the first half and higher in the second, exports maintaining resilience, investment gradually warming up and goods consumption facing short-term pressure.

Moving forward, the international situation presents both challenges and opportunities, while domestic policies will promote both economic expansion and reform. During the 15th Five-Year Plan period, the Chinese economy may embark on a journey with "clear skies that stretch for thousands of miles".

In the short term, we expect China-US relations to maintain a state of "conflict without breakdown" in 2026. The China-US rivalry may continue, but its intensity will be manageable, with the response of financial markets likely to be relatively "dull".

Affected by the election cycle, we anticipate that there might still be phases of disturbances to China-US relations during the first quarter and fourth quarter of 2026, while the second and third quarters will see the Trump administration focus on the midterm elections, potentially leading to a more tranquil external environment.

In the long term, the Trump administration is accelerating the "destructive restructuring" of US hegemony. Countries around the world are experiencing common shifts in industrial policy, trade policy, economic governance policy and social diplomacy policy, exacerbating the fragmentation and reconstruction of the global industrial and financial order.

Against this backdrop, we believe that the going-global process of Chinese enterprises and the internationalization of the renminbi will continue to accelerate. At the real economy level, with the rapid enhancement of China's industrial competitiveness, the export of technologies, brands and business models is particularly promising.

In the financial sector, as Chinese enterprises expand globally, coupled with deep-seated concerns about the dollar system, the internationalization of the RMB also faces strategic opportunities. The opening-up of the capital account and the construction of the RMB cross-border payment system could be crucial tools.

During the 15th Five-Year Plan period, industrial policies may focus on reshaping the profit growth of manufacturing through "anti-involution" while promoting the convergence of various factors toward manufacturing to foster the development of emerging pillar industries.

Overall, building a modernized industrial system with advanced manufacturing as its backbone requires first addressing the involution-style competition issue, ensuring a virtuous cycle from technological innovation to profit growth for enterprises, and forming a positive demonstration effect for industrial transformation and upgrading.

From a structural perspective, the 15th Five-Year Plan period will usher in a critical period for China's manufacturing to transition from scale to strength.

On the one hand, the consolidation and improvement of traditional industries will solidify the foundation of manufacturing. On the other hand, China will accelerate the industrialization of artificial intelligence technology, focusing on developing new pillar industries, such as new energy and aerospace, while also making forward-looking arrangements for future-oriented industries, such as embodied intelligence and sixth-generation mobile communication, promoting both reasonable quantitative growth and effective qualitative improvements in manufacturing.

In terms of supportive measures, the first is to adhere to the principle of "three concentrations" for State-owned capital, namely, pushing State-owned capital to concentrate on important industries and key areas related to national security and the lifeline of the national economy, toward public services, emergency capabilities, and public welfare areas related to the national economy and people's livelihood, and toward forward-looking strategic emerging industries, thereby reinforcing the leading role of central State-owned enterprises in technological innovation.

The second is to seize the opportunity of promoting mass entrepreneurship and innovation, enhancing the capital market's support for new quality productive forces; and the third is to lead with the carbon peaking goal, driving the green and low-carbon transformation of energy and industrial structures.

During the 15th Five-Year Plan period, China's economic growth rate may reach around 4.8 percent, while the policy focus will tilt more toward demand, with services consumption coming to the fore.

At the aggregate level, to achieve the goal of doubling the economic volume or per capita income by 2035, we estimate that the desirable economic growth rate during the 15th Five-Year Plan period should be around 4.8 percent.

We believe that the policy focus will gradually shift from the previous emphasis on the supply side to a more balanced approach with a tilt toward the demand side. Under the impetus of new drivers, such as services consumption and investment in emerging industries, the contribution of domestic demand to GDP is likely to steadily increase.

Regarding the framework of consumption policies, the four core directions for improving household consumption are: adjusting the income distribution structure to enhance households' consumption capacity, reforming the social security system to boost people's willingness to consume, supporting the repair of household balance sheets with the recovery of the capital market through wealth effects, and increasing fiscal efforts in "investing in people" to improve the supply system of service consumption.

Looking ahead to next year, we expect the demand side to exhibit the following structural pattern: external demand will be stronger than domestic demand, subsidized goods will outperform non-subsidized goods, demand for new industries will surpass that for old industries, and lower-tier cities will perform better than higher-tier cities.

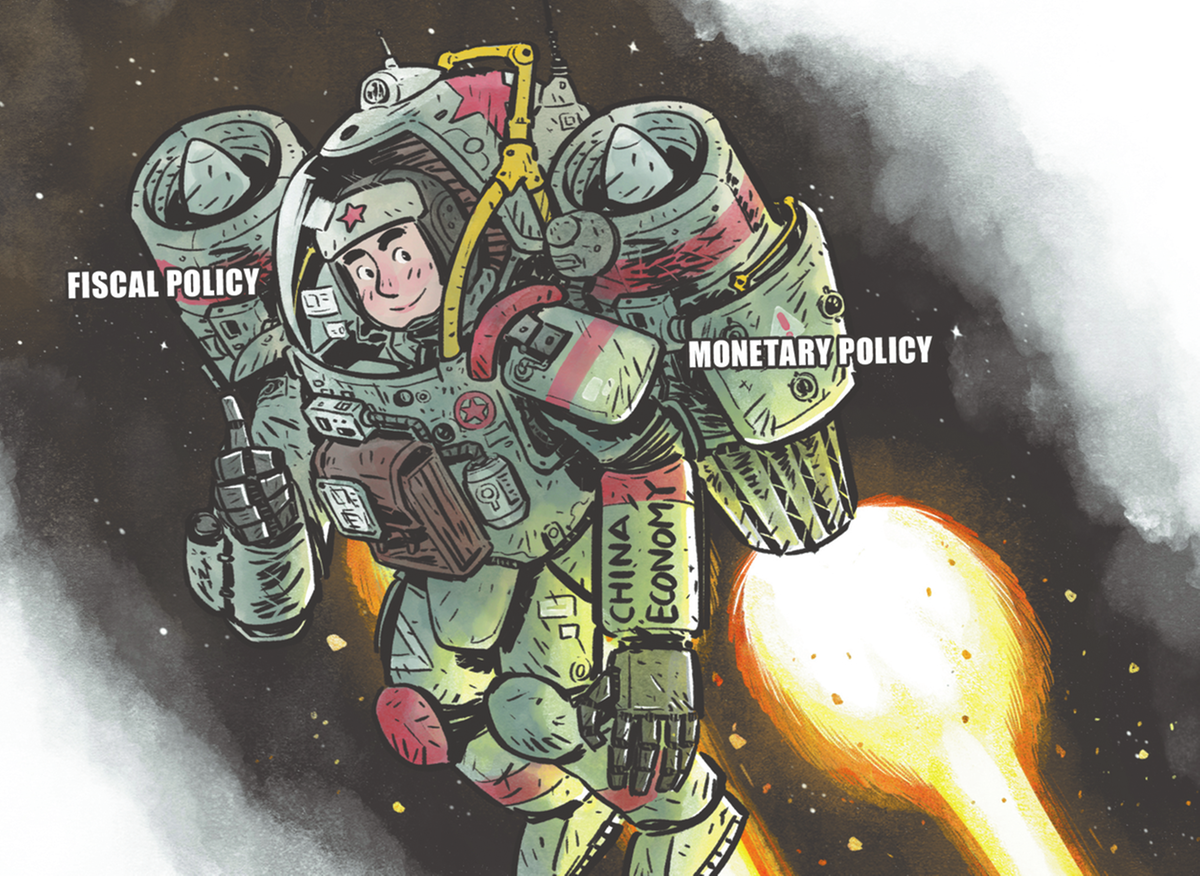

China will step up fiscal and monetary policy as required in 2026, leading to a mild macroeconomic recovery amid structural divergence.

In our view, fiscal policy will continue its mild expansionary path, optimizing the allocation of fiscal funds and accelerating the transformation of local government financing vehicles. Monetary policy will maintain a moderately loose tone, focusing on structural adjustments.

On the investment side, we expect infrastructure investment to slightly rebound, underpinned by a strong start and a more balanced tilt toward local fiscal risk prevention. Manufacturing investment, while constrained by "anti-involution" policies, will benefit from accelerated capacity reduction, which will promote the supply-demand equilibrium, with high-tech sectors emerging as a focal point.

The real estate sector is on track to see a narrowing decline due to supply contraction, easing pressure on housing prices, and supportive policies. On the consumption side, goods consumption is likely to remain weak, affected by some demand being pulled forward by subsidies and the lag in household balance sheet recovery.

However, wealth effects from financial assets will continue to unfold, and services consumption, driven by the policy orientation of "investing in people", will form a structural highlight.

On the export side, strong demand from non-US regions, capacity relocation and enhanced industrial competitiveness, combined with a moderate economic recovery in the US, will ensure that export growth remains resilient.

On the price front, the producer price index and the consumer price index will benefit from improved supply-demand dynamics under the "anti-involution" campaign and support from core commodity prices, leading to a mild recovery.

There are still risks as global geopolitical tensions may unexpectedly worsen. Other potential risks include the economic performance of developed economies declining more than expected, domestic macro policies falling short of expectations and reform progress disappointing.

The writer is chief macro and policy analyst at CITIC Securities.

The views do not necessarily reflect those of China Daily.